Six Coefficient-The tool for studying a finance

[One reform of a tax and social security]

It is an application which can calculate easily six coefficients, a final worth factor, a present value factor, a sinking fund factor, a uniform series final worth factor, a capital recovery factor, and a uniform series present worth factor, used when carrying out the compound interest operation of the financial assets.

Since the examination of FP (financial planner) is also the knowledge which is certainly needed, the same Mika is not found, either.

1. final worth factor

When the compound interest operation of the fund owned at present is carried out at a fixed, fixed interest rate during the period, it is a coefficient which asks for the amount of money receivable after the period.

Final value = future money.

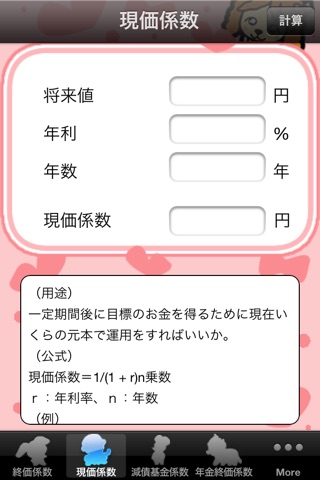

2. present value factor

A final worth factor is a coefficient which asks for it is necessary how much to prepare at present for preparing a fund required after a certain fixed period conversely.

Current price = money which it has now.

3. sinking fund factor

In order to prepare a fund required after a certain fixed period, it is a coefficient which asks for it is necessary how much to save every year.

Furthermore, since what divided it by 12 serves as monthly amounts funded, it is a coefficient which gets used easiliest.

4. uniform series final worth factor

The final worth factor which is not attached to “Settougo” at all was also a coefficient which asks for the future total amount.

That to which a difference is not attached is a case where only the first capital instead of savings is employed.

On the other hand, a uniform series final worth factor is a coefficient which saves and asks for the total amount at the time.

5. capital recovery factor

When the compound interest operation of the fund owned at present is carried out at a fixed, fixed interest rate during the period, it is a coefficient which asks for how much it is receivable every year.

6. uniform series present worth factor

This is also a pattern which is different by whether a pension is attached to “Settougo”, or it is not attached.

Although it is a coefficient which asks for how much capital is required of both this time, the direction where a pension is not attached does not have continuity and the attached direction asks for the current price with continuity.

Since the example is also published on a calculation page, it can imagine more concretely.

In addition, since the request of indication of the error of a text or an item addition wants to correspond by update, please give notice to a support site in that case.

About the inquiry from which demand is expected on the whole, I will correspond instancy.